Why CME's Glitch is a Catalyst for Innovation - Traders Panic

Okay, folks, buckle up. What happened with the CME outage wasn't *just* a glitch; it was a stress test, a wake-up call, and—dare I say it—a sneak peek at the future of finance. I know, I know, "glitch" sounds so… mundane. But trust me, this is anything but.

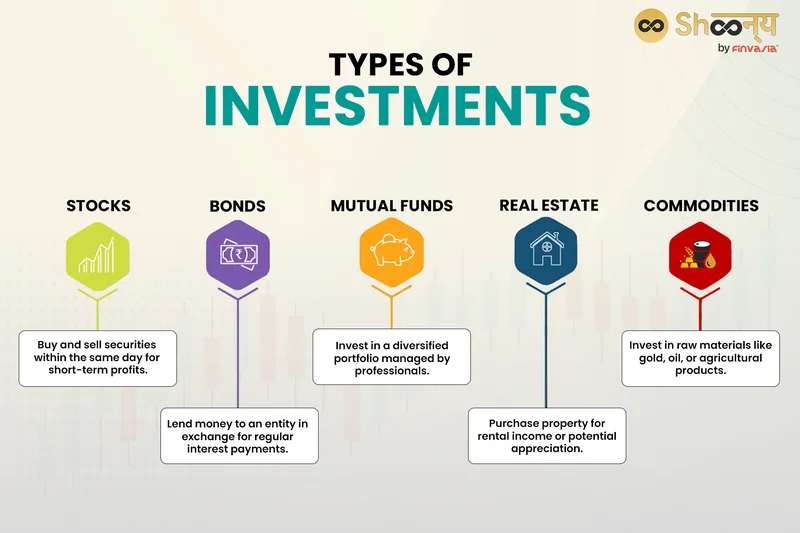

Think about it: the world's biggest exchange operator, suddenly brought to a standstill by a cooling issue at a data center. Currency platforms, futures, commodities, stocks—all frozen. It's like a scene from a sci-fi movie where the system crashes, except this was real life. And while some traders were scrambling, others were getting a glimpse of what a truly resilient, decentralized financial system *could* look like.

The Day the Markets Froze: A Wake-Up Call?

The Great Freeze of '24: More Than Just a Bad Day Now, let's be clear: the immediate impact was, as one trader put it, "a pain in the arse." Brokers were flying blind, hesitant to trade without live prices. CMC Markets even had to pull trade on some commodities, relying on internal data to keep things moving. Christopher Forbes of CMC said he’d never seen such a widespread outage in his 20 years in the business! Imagine the scramble, the risk assessments, the sheer *panic* that must have rippled through trading floors. It’s a bit like a city-wide power outage, but instead of lights going out, it’s the flow of capital that grinds to a halt.Decentralization: The Safety Net for a Chaotic World

Decentralization as a Safety Net But here's where it gets interesting. Spot forex traders, those nimble enough to operate outside the rigid structures of the CME, were able to find other venues to execute deals. This is crucial. It highlights the inherent strength of a diversified ecosystem. The outage, while disruptive, didn't bring the entire financial world to its knees. It just exposed the vulnerabilities of a centralized system. And that, my friends, is a good thing.Single Point of Failure: Are Centralized Systems Too Fragile?

Control and Fragility: A Centralized System's Weakness This wasn't just about lost profits or delayed trades. It was about the fundamental question of control. When a single point of failure—a cooling system, of all things—can bring a massive exchange to a standstill, it forces us to confront the fragility of our current infrastructure. It begs the question: are we *too* reliant on these centralized behemoths?DeFi to the Rescue: Building a Financial Safety Net

The Promise of a Distributed Network What if, instead, we had a more distributed, resilient network? What if trading could seamlessly shift to alternative platforms in the event of an outage? What if decentralized finance (DeFi), with its inherent redundancy and fault tolerance, wasn't just a niche concept but the *backbone* of the global financial system? I know, it sounds like a pipe dream. But is it, really? This glitch just showed us the cracks, and now we have the opportunity to address them.Human Ingenuity: The Antidote to Algorithmic Armageddon

The Human Element in a Digital World The outage also served as a reminder of the human element in finance. In a world increasingly dominated by algorithms and automated trading, the ability of traders to adapt, improvise, and find alternative solutions proved invaluable. It's a testament to the resilience and ingenuity of the human spirit, even in the face of a market meltdown.Beyond the Glitch: Building a Financial Ecosystem for Tomorrow

Addressing the Root Cause and Building Resilience The CME, to its credit, is working to resolve the issue. But the incident raises broader questions about the resilience of our financial infrastructure. Are we too reliant on centralized systems? Are we adequately prepared for unforeseen events? And what steps can we take to build a more robust and decentralized financial future?Cooling Glitch, Hot Opportunity: Reimagining Market Stability

Thin Trading and Volatile Markets The outage happened on a day when trading volumes were already expected to be thin due to the Thanksgiving holiday. As Tony Sycamore, market analyst at IG, pointed out, it "hasn't helped at all, more so given there is interest to transact at the end of what has been a volatile month." But maybe, just maybe, this disruption will ultimately lead to a more stable and secure financial ecosystem. According to CME glitch hits FX, commodities and stock futures By Reuters, the outage was due to a cooling issue at data centers. A Glimpse of Tomorrow's FinanceFrom Glitch to Genesis: DeFi's Decentralized Dawn

The CME Glitch as a Catalyst for Change So, what's the big takeaway? The CME glitch wasn't just a technical hiccup; it was a catalyst. It exposed vulnerabilities, sparked conversations, and, most importantly, accelerated the shift towards a more decentralized and resilient financial future. It's a bit like the early days of the internet—clunky, unreliable, but full of potential. And just as the internet transformed the world, DeFi has the potential to revolutionize finance.DeFi's Promise: Equity, Ethics, and a Sustainable Future

Ethical Considerations in a Decentralized Future But with great power comes great responsibility. As we move towards a more decentralized future, we must also address the ethical considerations. How do we ensure that DeFi is accessible to everyone, not just the privileged few? How do we prevent it from being used for illicit activities? And how do we protect investors from fraud and manipulation? These are not easy questions, but they are essential if we want to build a truly equitable and sustainable financial system.Glitches and Greatness: Building Tomorrow, Today

Closing Thoughts This is the kind of breakthrough that reminds me why I got into this field in the first place. When I first read about the news, I just sat back in my chair, speechless. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend. What this means for us is... but more importantly, what could it mean for *you*? The Future is Being Built, One Glitch at a Time

Related Articles

Fed's Latest Minutes: What the Data Reveals About Rate Cuts and Internal Disagreement

The Federal Open Market Committee just released the minutes from its September meeting, and if you w...

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

Lisa Su: the 'expectations' driving AMD's stock pump

AMD's Billion-Dollar Dreams: Are We Really Buying This Hype? Alright, folks, gather 'round. AMD had...

Crypto Market Faces Headwinds: Analyzing the Macro Signals Driving the Dip

Generated Title: Bitcoin's Silent Standoff: Why a Sideways Market Masks a Brewing Storm The chatter...

IBM's Q3 Earnings Beat: Deconstructing the Market's Negative Reaction

Generated Title: IBM Beat the Numbers, But Lost the Narrative. Here's Why. It’s a classic Wall Stree...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...