October DeFi Crash: The 2025 Rebound Myth? - Reddit's Coping Hard

Okay, here's the article with added subheadings:

JUP Price Predictions: Separating Data From Delusion

Jupiter (JUP) Price Predictions: A Data-Driven Reality Check Okay, let's talk about Jupiter (JUP). Everyone's got a price prediction, right? This coin will hit $5! No, $10! I've seen the charts, the "expert" analyses, and the fervent community posts. But as a former data analyst, I'm trained to ask: does the data actually *support* the hype? Spoiler alert: not really.Jupiter's Moonshot: Hype vs. Hard Numbers

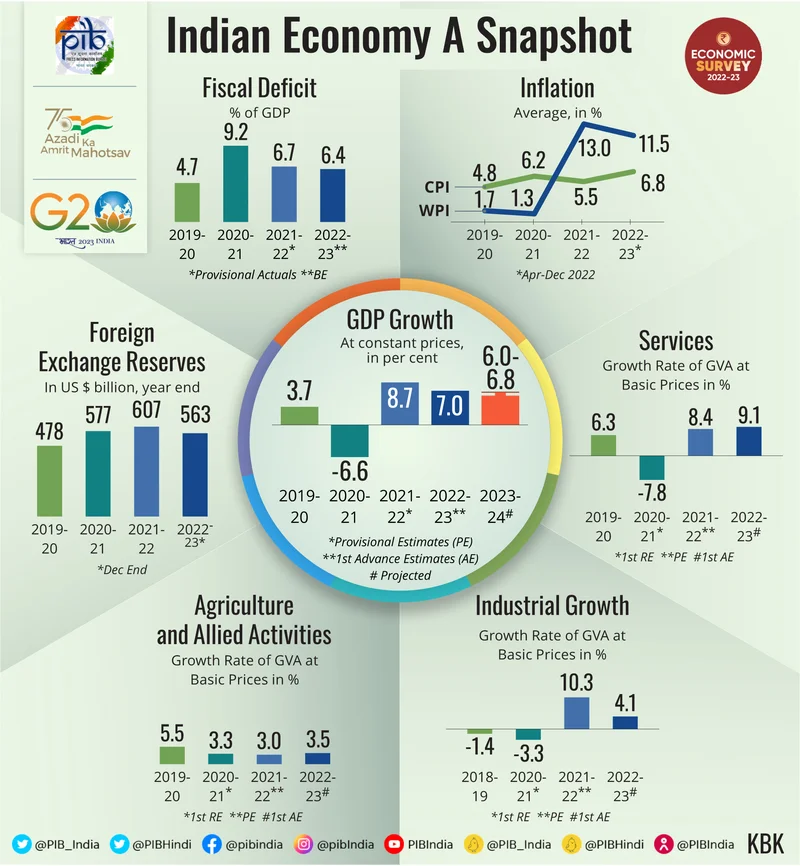

The Core Narrative vs. Current Market Reality The core narrative is that Jupiter, a DEX aggregator on Solana, is poised for massive growth. It's the backbone of Solana DeFi, they say. But let's look at the numbers. As of mid-November 2025, JUP is trading around $0.35–$0.4. It's been in a consolidation range for months. One report claims a potential high of $5.29 by year's end (a 1400% increase!). Another is far more reserved. Which one do we believe?Jupiter's Price Chart: A Reality Check

Deconstructing Jupiter's Performance Let's deconstruct this. Jupiter *is* a key player on Solana. No argument there. But "key player" doesn't automatically translate to parabolic price increases. The token launched in January 2024 with an IDO price of $0.55 and briefly touched $2 before crashing. A 75% drop in 24 hours isn't exactly a sign of rock-solid fundamentals. Sure, it recovered somewhat, but it's been mostly downhill since.$0.85 by '25? More Like Wishful Thinking

Analyst Projections and Their Limitations The Noone Wallet Analysis Team – and I appreciate their detailed approach – projected JUP could reach $0.85 by the end of 2025, *if* it maintains its role as a liquidity hub. That's a lot of "ifs." And remember that was in late October, with a reference price of $0.44. We're already in mid-November, and it hasn't even broken above that reference point.Jupiter's Revenue Mirage: Impressive Numbers, Shrinking Value

Revenue vs. Market Cap: A Discrepancy Here's where my former hedge fund instincts kick in. Revenue. Blockworks reported that Jupiter generated $45 million in revenue in Q3 2025, which is impressive. But the market cap *also* dropped significantly during that time, from $3 billion to $1.1 billion. This discrepancy is…interesting (to put it mildly). Why is a revenue-generating platform losing market cap?JUP Token: Governance or Just a Placebo?

The JUP Token's Value Proposition One explanation, and this is purely speculative, is that the JUP token itself isn't directly tied enough to the platform's success. It's a governance token, yes, but does holding JUP actually provide significant benefits to users or stakers? The data isn't clear. This is the part of the report that I find genuinely puzzling.Price Predictions: Best-Case Fantasies?

Questioning Long-Term Price Forecasts And speaking of data, let's talk about those price predictions. Telegaon, for example, forecasts a minimum of $38.34 and a maximum of $46.25 by 2030. That's a 10,900% increase from today. What assumptions are baked into that model? Unfettered growth of Solana? Jupiter becoming the *only* DEX aggregator in the world? These kinds of projections often rely on best-case scenarios that rarely materialize.JUP Token: Technicals Say "Sell," But Is That the Whole Story?

Technical Analysis and Community Sentiment Now, I'm not saying Jupiter is worthless. Far from it. It's a useful tool, and the team is clearly building. But the JUP token itself? It's a different story. The technical analysis is mostly bearish. Moving averages point to "Sell." Trend indicators show weakness. As one report said, "Jupiter needs stronger volume and a decisive break above major resistance before any long-term bullish reversal takes shape."Enthusiasm vs. Reality: A Data-Driven Wake-Up Call

Community Sentiment vs. Reality And let's be honest, the community sentiment, while enthusiastic, is often detached from reality. I see posts hyping "guaranteed gains" and ignoring the risks. That’s not analysis; that's gambling.Solana's Fate: Jupiter's Risky Bet

The Solana Factor It's impossible to analyze JUP without considering Solana. Jupiter's success is inextricably linked to Solana's success. If Solana falters, so does Jupiter. The growth of Solana-based DeFi is crucial. More users, more liquidity, more transactions – all benefit Jupiter. But Solana faces competition from other Layer-1 blockchains. It's not a guaranteed winner.Solana DeFi: Adoption Reality Check?

Reliance on Solana DeFi Adoption One crucial aspect that has me on the fence is the reliance on adoption of Solana-based DeFi applications. DeFi Token Performance & Investor Trends Post-October Crash I mean, how many people do you know who are actually using DeFi apps daily? This is not meant as a slight to Solana, but rather to highlight the real-world limitations of the entire sector.Bearish Scenarios: Solana Stumbles or Crypto Collapses?

Potential Risks and Bearish Scenarios The bear case is that other DEX aggregators emerge, Solana experiences technical difficulties, or the overall crypto market crashes. These are all real possibilities.JUP Token: Hype Over Substance?

Conclusion: Temper Expectations So, What's the Real Story? Jupiter has potential, sure, but the current price predictions are mostly hot air. The JUP token needs a stronger value proposition and the platform needs to translate revenue into tangible benefits for token holders. Until then, temper your expectations and don't get caught up in the hype. The numbers simply don't support it.

Related Articles

The Food Safety System That Worked: Inside the Egg Recall and the Tech That Stopped a Crisis

This Egg Recall Exposes a Flaw in Our Reality—And the Tech That Will Fix It You probably saw the hea...

PI: Dabo Swinney's Outrage

When Football and AI Collide: A Numbers Game The world of college football witnessed a stunning upse...

Plasma: What It Is, How It Saves Lives, and What Comes Next

The night sky over Wyoming split open. It wasn’t the familiar, ghostly dance of the aurora that Andr...

Solana Price Drop: What's Behind It All?

Solana's Dip? Nah, It's Wall Street Loading Up the Rocket Fuel! Okay, folks, let's talk Solana. I kn...

B&M Recalls Harvest Mug: Why Your 'Cozy' Fall Mug Might Just Explode

So let me get this straight. The primary, singular, unassailable function of a mug is to hold hot li...

Aster Trade's Wild Ride: CZ's Investment, DEX Upgrade, and Token Volatility

Dr. Thorne: Can CZ's "Unlucky Charm" Actually Be Crypto's Lucky Break? Okay, folks, buckle up becaus...