DeFi's 'Recovery': Still a Scam? - Holders React

DeFi's "Safe Haven" Play? Don't Make Me Laugh.

Okay, so the narrative du jour is that investors are supposedly flocking to "safer" DeFi tokens after the October crash. Please. As if anything in DeFi is actually safe. It's like saying you're seeking refuge from a hurricane by hiding in a cardboard box. Sure, it might offer a tiny bit of protection, but let's be real.

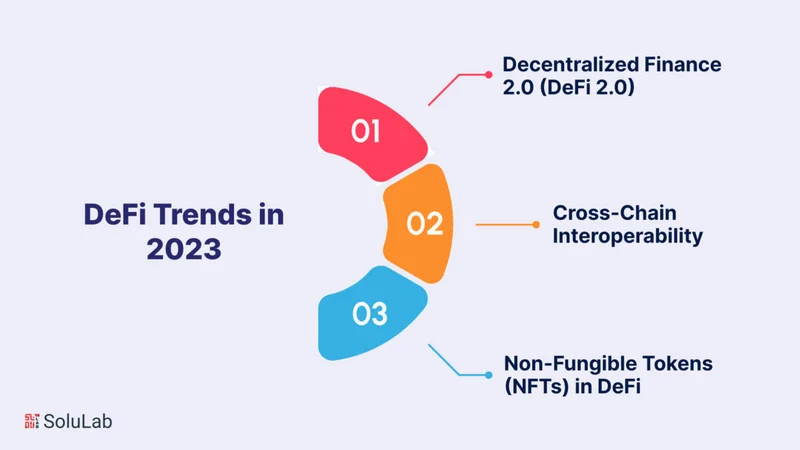

This FalconX report claims people are piling into "buyback" names like HYPE and CAKE, or tokens with "fundamental catalysts" like MORPHO and SYRUP. Right. So, because HYPE is "only" down 16% QTD, and CAKE is down 12%, that's considered a win? That's like celebrating surviving a car crash with only a broken arm. And these "fundamental catalysts"? It's crypto—the catalysts are usually just hype-fueled speculation disguised as "innovation". What happens when the hype fades?

And then there's the lending sector. Apparently, investors are "crowding" into lending names because it's supposedly "stickier" than trading. Stickier like flypaper is sticky, maybe. Sure, people might be looking for yield in stablecoins as they flee the rest of the market, but let's not pretend lending protocols are some bastion of stability. Remember Stream finance? Anyone? Didn't think so.

DEXes: Cheap for a Reason?

The report also notes that some DEXes have gotten "cheaper" relative to September 30th. Okay, they use the term “price-to-sales multiples”. Let me translate: the price has tanked faster than the actual usage. DeFi Token Performance & Investor Trends Post-October Crash

And the reason for this is offcourse obvious.

I mean, come on, people. If something's on sale, it's usually because nobody wants it. The report suggests that cheaper DEXes might be due to "lower growth expectations." No freakin' kidding. The only thing growing faster than my cynicism in this market is the number of failed DeFi projects.

The report then throws out names like AAVE and MORPHO as examples of fintech integrations driving growth. But are we really supposed to believe these integrations are anything more than PR stunts? AAVE adding a "high-yield savings account"? Give me a break. Banks already offer savings accounts, and they don't require you to navigate the minefield of DeFi protocols.

Solana: Still Waiting for the Explosion

Then there's Solana. Oh, Solana. The blockchain that promised to be the "Ethereum killer" and deliver world-shattering TPS. The article brags about 1,000+ transactions per second and near-constant uptime. Cool. So what? My grandma's email client can handle thousands of messages per second. The problem with Solana isn't the tech; it's the fact that nobody's actually using it for anything meaningful.

The article claims that DeFi and NFT activity are "expanding" on Solana. Okay, expanding like a puddle in the desert maybe. It also points out the low transaction fees ($0.00025 per transaction). That's great, I guess, if you're into microtransactions for virtual cat pictures.

But wait, are we really supposed to believe this network can truly scale when major NFT drops still cause congestion? The article admits this, but dismisses it as "temporary." Sure, just like my New Year's resolutions are temporary.

And let's not forget the constant comparisons to Ethereum. Solana is "considerably more efficient, scalable, and cost-effective." Yeah, yeah, we've heard it all before. But Ethereum still has the network effect, the developer community, and the vast majority of DeFi activity. Solana is just a sideshow.

Give Me a Break...

This whole "safe haven" narrative is just another way for crypto bros to shill their bags. DeFi ain't safe, Solana ain't the future, and I'm ain't holding my breath for any of this to change. It's all just a big, complicated casino, and the house always wins.

Previous Post:DeFi's Unstoppable Surge Post-October Crash: Charting Tomorrow's Investor Trends and Our Collective Future

No newer articles...

Related Articles

Internet Computer: What's Behind the Crypto Surge?

Internet Computer's 37% Jump: A Glimpse into the Future of Blockchain Stability? Alright, folks, buc...

Concordium's Market Attention: A Soaring CCD and What It Means

Concordium's Compliance Play: Is It Enough to Win? Concordium is making a serious bet on compliance....

The Rise of Concordium: What It Is, Why It's Surging, and What Comes Next

For years, the crypto world has been dominated by a single, rebellious narrative: decentralize every...

Solana's Bull Party is Over: What Happened?

Okay, so Solana crapped the bed yesterday. Broke below some "upward trendline" from April, and now e...

B&M Recalls Harvest Mug: Why Your 'Cozy' Fall Mug Might Just Explode

So let me get this straight. The primary, singular, unassailable function of a mug is to hold hot li...

The Aster DEX Breakthrough: What It Is and Why It’s a Glimpse Into DeFi’s Future

A number gets thrown around in technology that is so large it almost loses its meaning: a trillion....